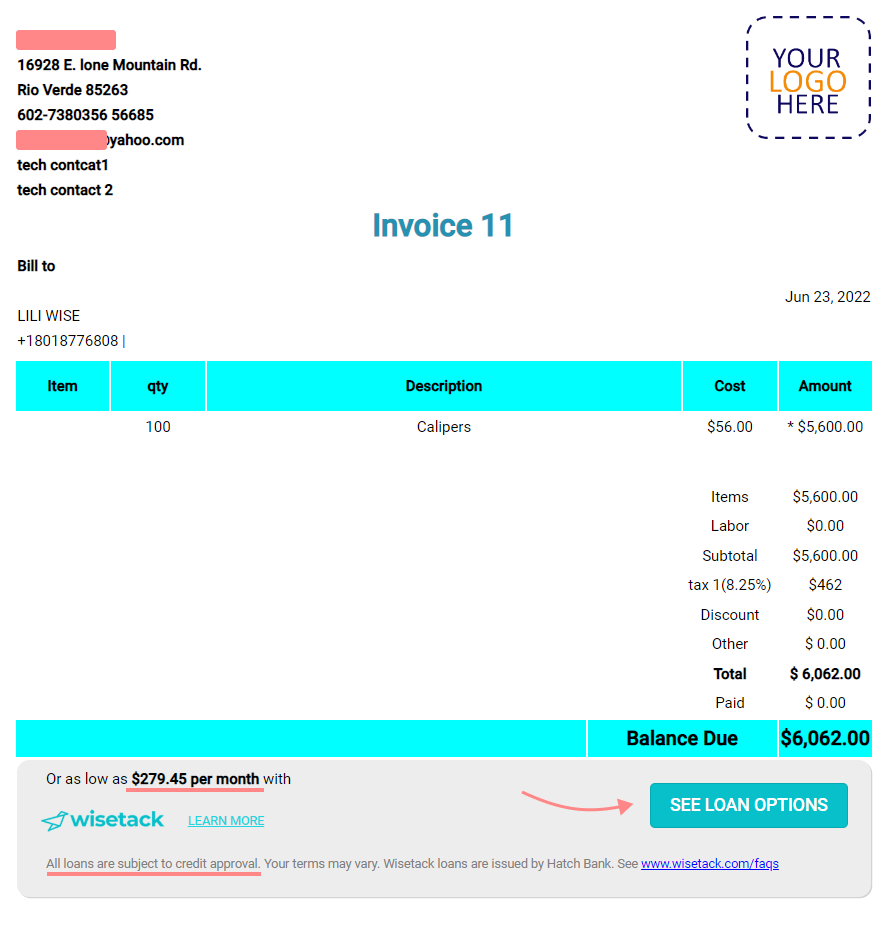

ARI has partnered with Wisetack to offer your clients extra payment options for auto repair services. The powerful integration lets customers apply for a loan for invoices between $500 and $15,000.*

They pay over time, and you get your money once you finish the job.

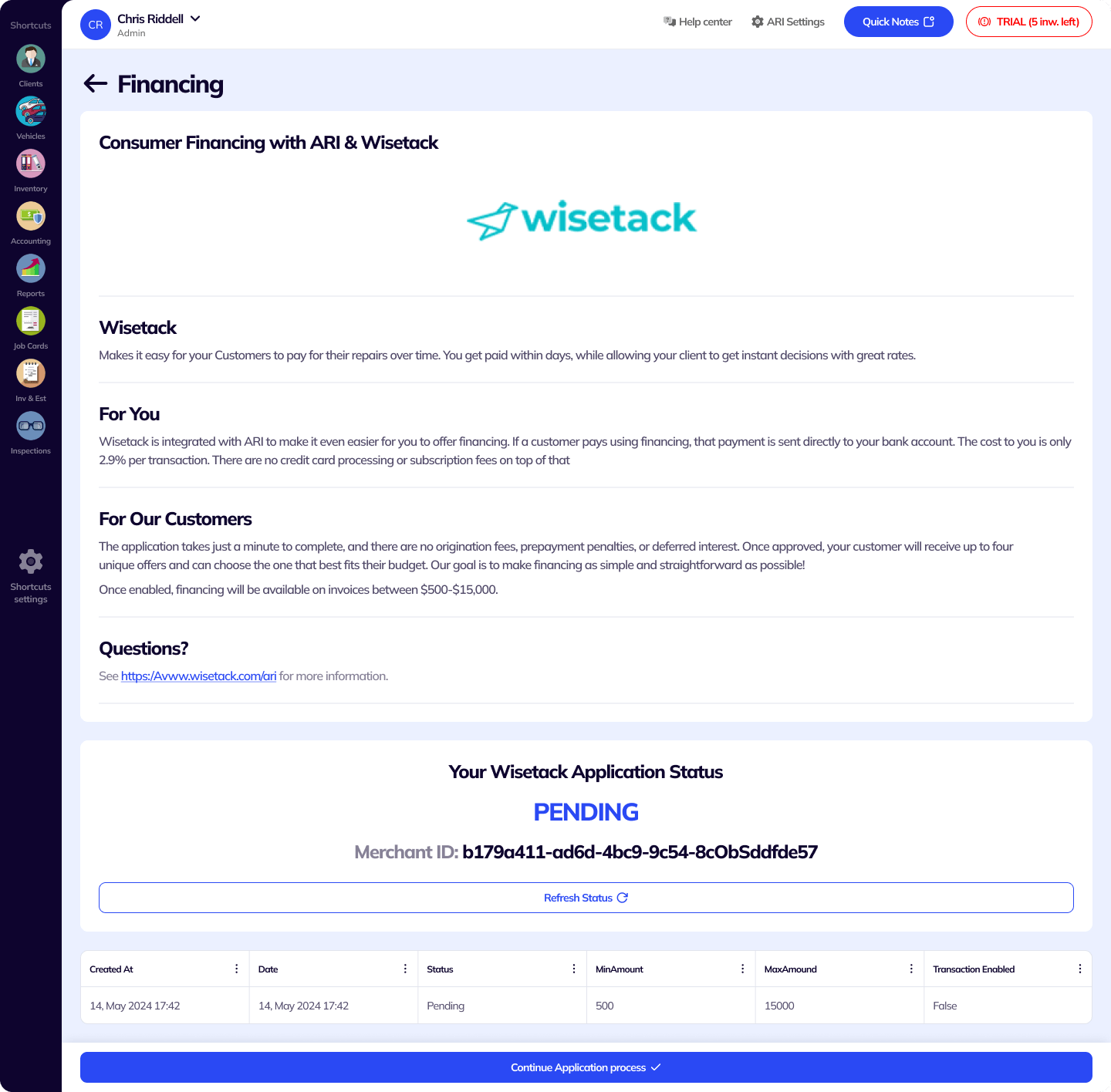

Login to ARI and click the Financing button to signup with Wisetack.

Before using Wisetack’s services in our app – you’ll need to sign up on their platform and be approved as a merchant. You can sign up in ARI and click the Wisetack logo on the home page to get started. Once the setup is complete – you will see Wisetack’s options active in the estimate, invoicing, and payments views. We’ll walk you through the process and explain all the details below. Meanwhile, check out our partner’s website and FAQs.

The first option Wisetack gives you is called a prequalification application. When customers pre-qualify, they’ll know the maximum loan amount they can take out with Wisetack, which helps them say yes to needed services.

Sending a pre-qualification application is easy. Simply create a new Job Card/ Estimate or open an existing one. Then click the Estimate button to preview your quote. Click the Send Application button to start the process.

Your customer will receive a text with the next steps.

In the ARI app, go to the “Settings” menu and choose “Online Payment Setup.” Select Wisetack. Review the information about Wisetack, then click the Sign Up button. When the application process is completed, you’ll see a unique merchant ID and an approval notification. The page also includes basic instructions on how to start offering consumer-friendly financing to your clients. Once you’re approved, Wisetack is accessible through the Estimates/ Job Cards, Invoices, and Payments views. This service is only available in the U.S.

The first step in diagnosing any modern vehicle is to hook it up to an OBD diagnostic tool so you can read the PIDs (Parameter IDs). The codes need to be decoded in order to understand where the issue really is. However, finding the location of the OBD port can sometimes prove to be quite a challenge. Luckily, thanks to the CarMD integration, ARI can show you pictures of where the OBD port is located based on the vehicle’s VIN

If found, you should see an image of the plug in location as well as a a picture of the plu itself.

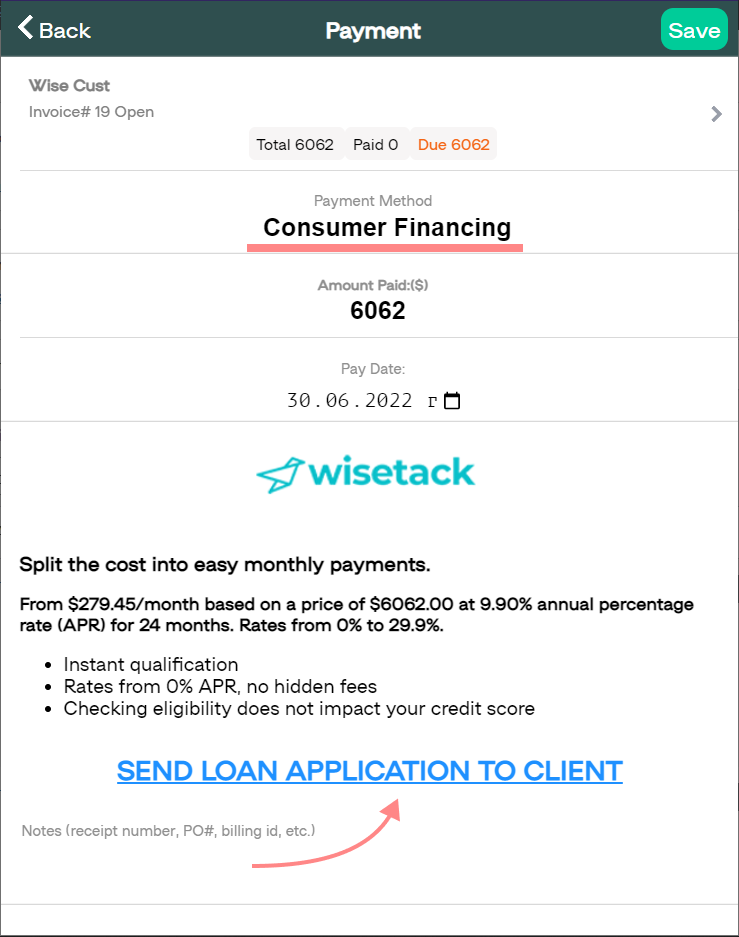

Wisetack is also available on the Payments screen, making it easy for your customer to select Wisetack when it’s time to settle up.

Simply open the Payments menu and create a new payment record. Then choose the Consumer Financing option and the relevant invoice. Click the Send Financing Application to Client button.

Once sent, the page shows a sticker with the client loan application status and details. This sticker updates as your client progress with the financing application.

Once your client is approved, the invoice updates in ARI.

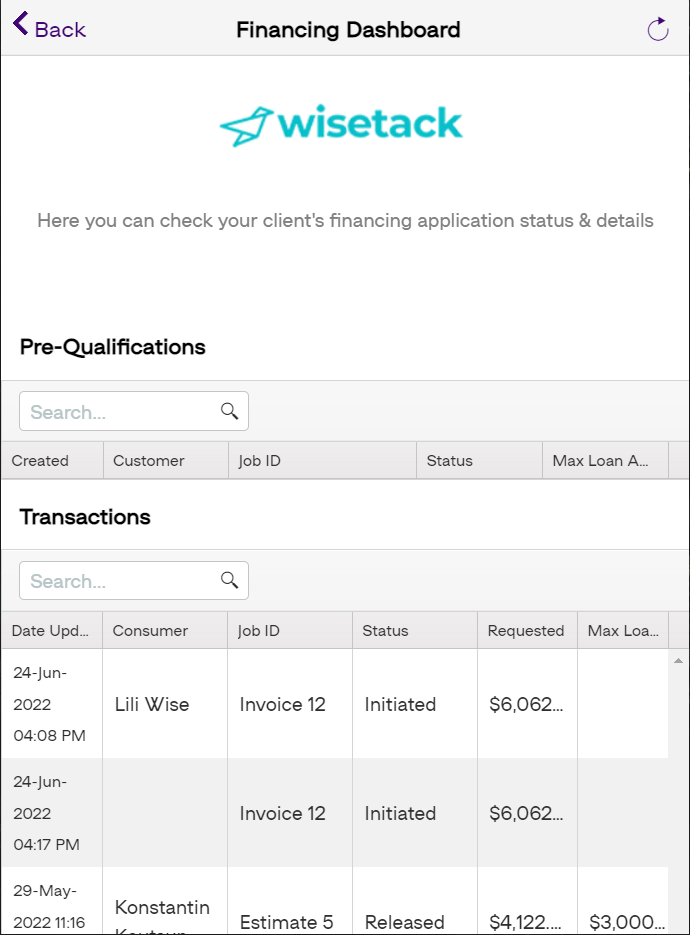

You can open the customer financing dashboard from our main menu by clicking on the “Financing” icon. The client dashboard will show up if you’ve already set up your merchant account with Wisetack. If your Wisetack account is not active – you will see the initial pre-sign-up page, similar to the one from the first screenshot.

The Wisetack dashboard includes information about the status of all client loans and applications. This allows you to easily track things like the amount a customer has been pre-qualified for or which invoices Wisetack has already paid you for.

You’ll also receive email updates all along the process, including information about the clients’ loan status and loan amount.

The common loan statuses you will see in the dashboard are: Initiated, Accepted, Applied, Released, Paid

Applying for a Wisetack loan is fast and easy for your customer. When you send a pre-qualification or loan request, the customer receives a text link on their mobile phone. Clicking the link opens the Wisetack loan application, where customers can securely enter basic personal and financial information. This usually takes less than a minute. When approved, clients will receive up to 6 loan options and can select the option that fits their needs.

24/7 Customer Support

Contact us via email at contact@ari.app, and we will reply promptly.

ARI Video Guides

ARI's official video library with all of the guides you need

ARI (Auto Repair Software) © 2026 | by uMob.ltd

800 N King Street

Suite 304 -1249

Wilmington, DE 19801

The Capterra logo is a service mark of Gartner, Inc. and/or its affiliates and is used herein with permission. All rights reserved.

Add clients, vehicles & all the details that are relevant to them

Create detailed inspections with checklists, damage reports

Manage your parts, tires, business assets, and all other important items.

Track labor progress, start & stop work clocks, approve & deny services.

Create professional quotes for your auto repair clients

Generate professional invoices for your auto shop’s clients

Generate damage reports & attach pictures to your auto inspections

Let your clients book your services online from the comfort of their home

Earn return customers by reminding them when service is due

Create purchase orders, track your expenses, and monitor your profits

Read Engine Error Codes with ARI monitor car’s parameters live

Reports for your business performance & export the data

Never miss a payment keep an eye on your invoice billing process

Reach your core customers & market business across different channels

Manage vendors, partners & orders for a streamlined repair experience

Monitor and label the activity of multiple employees

Receive payments on your Online Invoices with the world’s most renowned payment networks

Order parts easily with PartsTech and ARI! Smooth and reliable parts procurement process.

Every mechanic benefits from quality Repair Guides and Car Repair Estimates.

Get Service History Instantly. Decode VINs and Plates with Accurate Data from a Leading Supplier.

Get Diagnostic & Maintenance Info. Access Diagnosis, Solutions, and Problem Predictions.

Sync ARI invoices to QuickBooks Online. Manage customers and inventory.

Get detailed labor guides, labor times, and estimates from the world's first AI labor guides system.

Process In-Person Payments On The Spot. Geared towards auto repair businesses.

ARI has partnered with Wisetack to offer your clients extra payment options for auto repair services.

You can access ARI on all major digital platforms.

A complete guide to setting up and running your auto repair business

ARI’s client portal lets clients easily stay informed when they visit you

How to add multiple users to your ARI Profile

You must ensure you keep your app updated all the time

ARI offers features and settings tailored for auto repair services

Welcome to ARI's blog for updates, articles, and guides

Here are our most notable achievements over the years.

Get the most out of your client management with our online documents

Test the features and see if it’s the right fit for you

Welcome To ARI's Official Video Library

Earn rewards and ARI credits by referring our app to friends