In the world of auto repairs, when it’s not about torque and transmissions, it’s often about tallying up those taxes. Hey mechanics and garage owners, if you’re settling into the auto business, you might want to stick around as the tax clock for 2024 is ticking, with April 15 as the finish line. However, if you have already done your taxes and all this is in your rearview mirror, keep in mind that the following tips provided by ARI (Automotive Repair Software) could give you a head start on the next.

Standard Tax Deductions

Your day’s likely full of engines and exhausts, not exemptions and write-offs. But knowing which expenses can take a pit stop from your taxable income might just rev your financial engines.

- Leasing costs for your workspace or any business-related real estate.

- Wages, bonuses, insurance perks, and vacation time are funded for your team.

- Essential utilities and supplies, from lubricants to filters and cleaning gear.

- Vehicle costs for business use, covering mileage logs, and upkeep.

- Investments in shop tools and diagnostic tech.

- Insurance plans to shield your operations from the unexpected.

- Promotional spending, like maintaining an online presence or local ads.

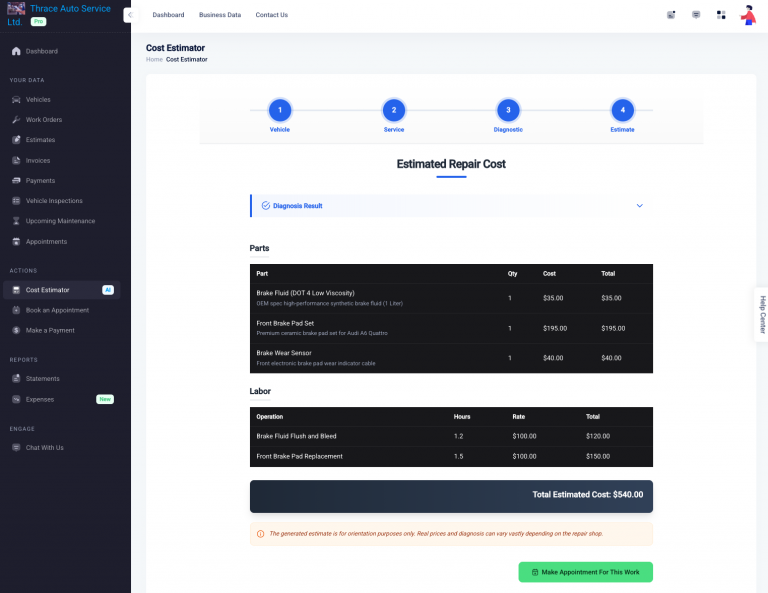

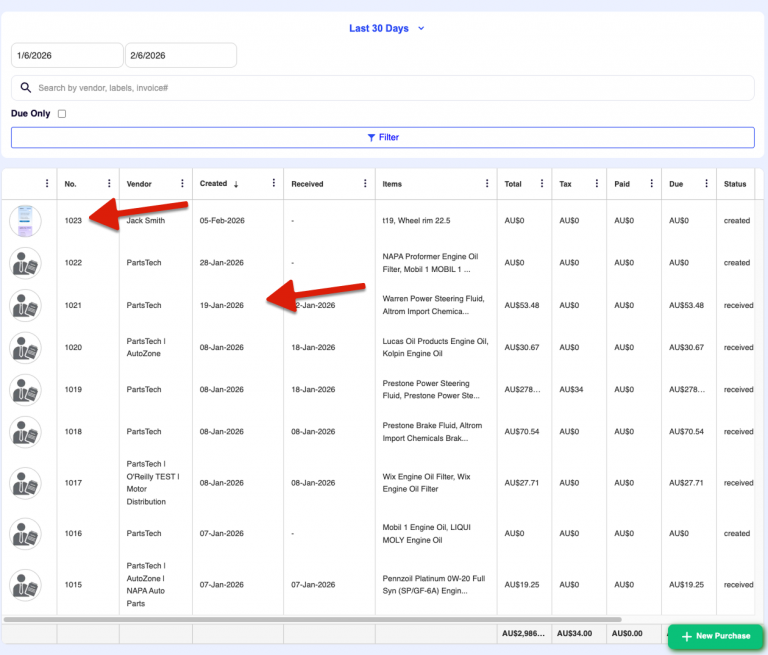

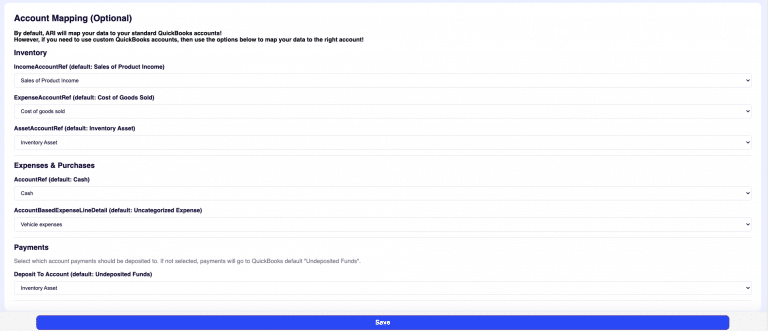

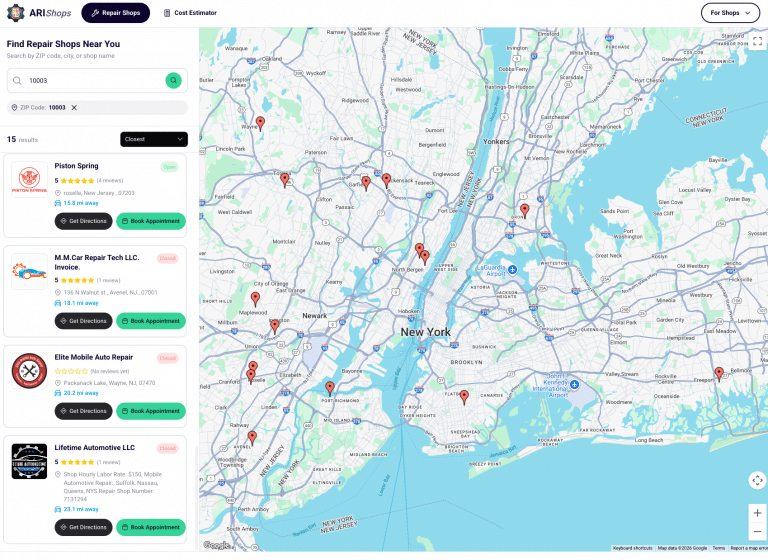

What if tracking these overheads and snagging every tax break could be easily managed? With ARI’s automotive repair software, slipping through the maze of receipts and expenses can be a breeze, offering reports and insights right at your greasy fingertips.

Special Tax Write-offs

Some of these might seem laser-focused, but if they align with your workshop, they’re worth a gander.

- Section 179 deduction can be a godsend, letting you write off the total price tag of newly purchased shop tools and equipment in one go.

- Work Opportunity Tax Credit (WOTC) might just give you a pat on the back for bringing certain team members on board.

- Energy-efficient building deductions – If you’ve got a green streak and your workshop is saving on energy, you might catch a break on the building front.

How ARI’s Automotive Repair Software Helps

Nailing those savings come tax time means the devil’s in the details – you’ve got to record with care and plan with precision. Here’s where ARI shines, giving you a digital hand.

A no-sweat system of logging every dime and dollar and auto repair invoice, with ARI’s do-it-all approach. Tax tools that help you peek ahead, scaling deductions against your earnings so you can keep more of what you make.

With ARI’s automotive repair software, accounting is less grunt work, and more strategy, helping you play the tax game like a champ.

Tax troubles? Not here. ARI’s got a tool chest that’s making waves in auto repair spaces, turning tax hurdles into a walk in the park. Get on board with ARI, and you’re geared up to transform tax season from a dreaded time sink to a power play for your enterprise.

Gear up your tax game – start your engines with ARI’s Accounting Features and leave the days of tax dread behind. It’s time to welcome a future where your shop’s finances are slicker than a fresh oil change. Dive into ARI’s digitized approach and watch your auto repair business thrive.